Benefits of C-PACE Financing for a Commercial Solar Project

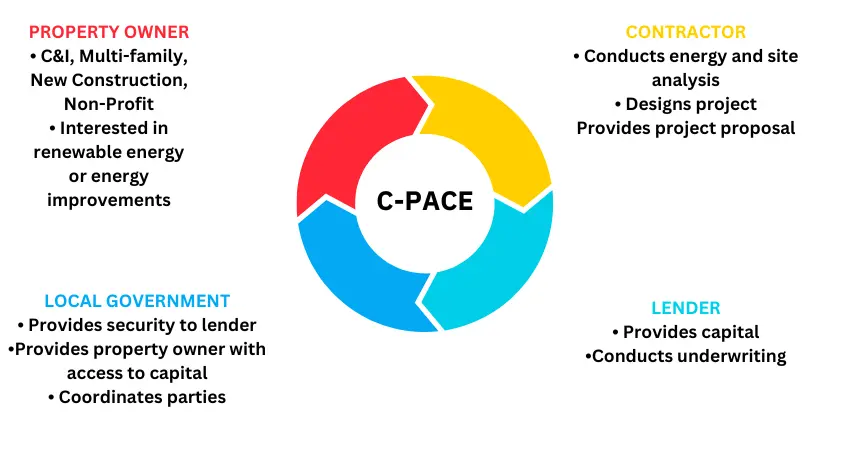

C-PACE offers a special way for commercial property owners to finance clean energy projects. Unlike traditional loan structures, C-PACE allows repayment through a voluntary property tax assessment. This method, known as commercial property assessed clean energy (C-PACE), helps in reducing energy and water usage

What is C-PACE Financing?

C-PACE is a green financing program designed to support commercial renewable energy, energy efficiency, water conservation, and resiliency projects. It covers 100% of the cost for solar panels, electric vehicle charging stations, and other eligible upgrades.

Key Features of C-PACE Financing:

- Full Funding: C-PACE covers the entire cost of the project, helping preserve working capital for other business needs.

- Enhanced Property Value: Implementing renewable energy improvements through C-PACE can increase the market value and marketability of commercial properties.

- Tax Benefits: Property owners can still receive incentives and tax credits for solar and energy efficiency projects from both local and federal sources.

- Transferable Financing: The financing obligation stays with the property, not the borrower. This means that if someone sells the property, the new owner takes on the remaining repayment obligations.

Types of Properties Eligible for C-PACE Financing:

C-PACE financing can help pay for energy upgrades and renewable energy projects in commercial and industrial buildings.

Building Types Eligible for C-PACE Financing:

- Agriculture

- Hotel

- Industrial

- Mixed-use

- Multi-family

- Office

- Retail

C-PACE offers a special way for property owners to pay for improvements by adding the cost to their property taxes. The projects help commercial properties save money and be more sustainable by using renewable energy sources and saving energy.

Is C-PACE a Good Fit for Your Organization?

Consider C-PACE financing if:

- Your business could benefit from energy efficiency or resiliency upgrades.

- You need long-term financing with lower monthly payments, typically over 20 years.

- Your organization may relocate in the future, as C-PACE financing stays with the property.

- You can access C-PACE financing in the jurisdiction where your property is located.

Where is C-PACE Available?

C-PACE financing is available in states and municipalities that have enacted PACE-enabling legislation. Right now, PACE laws are in place in 38 states include: AK, CA, CO, CT, DE, FL, GA, HI, ID, IL, KY, MA, MD, ME, MI, MN, MO, MT, NE, NJ, NM, NV, NY, OH, OK, OR, PA, RI, TN, TX, UT, VA, WA, WI & D.C. C-PACE programs are running in 30 states and Washington, D.C. You can verify eligibility for your project location by visiting PACE Nation.

Wisconsin-Based C-PACE Programs

In Wisconsin, 53 counties have implemented C-PACE programs. This includes a program called PACE Wisconsin that operates statewide.

Independent municipal programs, such as the City of Milwaukee C-PACE Program, also exist. These programs assist property owners in reducing their carbon footprint and saving money on utilities. They achieve this by providing financing for clean energy and energy efficiency projects through C-PACE.

Impact of PACE Financing

PACE financing has clear benefits like lower energy and water use, reduced pollutants, and decreased hazard vulnerability. However, this financing also generates economic co-benefits, both directly and indirectly.

PACE Nation reports that C-PACE has funded over 2,900 projects nationwide. These projects amount to $4.2 billion in green investments. This has created 52,000 jobs and helped communities of all sizes with economic development. C-PACE not only benefits local economies but also enables municipalities to achieve energy efficiency and renewable energy goals without financial risk.