How to fill out form 5695 for Solar Panels

The Solar Tax Credit is a reward for homeowners who switch to solar power. It is also known as the Residential Clean Energy Credit. This credit can substantially reduce your taxes, but to benefit, you need to correctly file Form 5695. Let’s explore how to naturally fill out Form 5695 for solar panels.

Starting in 2024, Form 5695 expands beyond solar panels. You can also use it for various qualified solar electric property energy efficiency improvements and residential energy property expenditures.

Should you require assistance in completing Form 5695 and availing the solar tax credit, this piece will be beneficial. Follow these step-by-step instructions to understand the process and receive the credit you deserve.

Understanding IRS Form 5695

If you install solar panels in your home, you can apply for a tax credit using IRS Form 5695. This form gives homeowners a tax credit for making energy-efficient improvements to their homes.

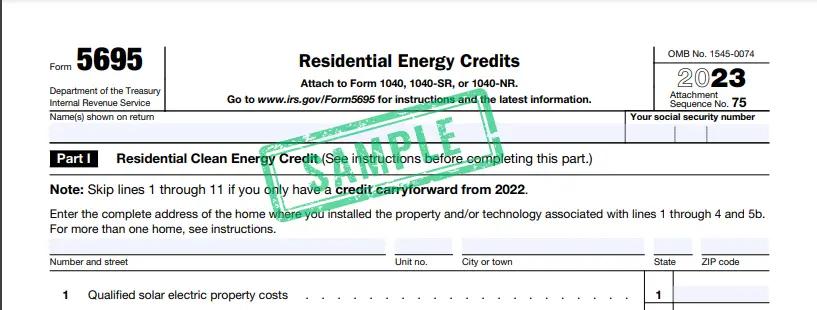

You can obtain Form 5695 and its instructions from the Internal Revenue Service (IRS) website. The form explains “Residential Energy Credits.”

The IRS uses this term to calculate credits for energy-efficient homes. You cannot refund these credits. Eligible improvements include solar panel systems, solar energy storage, fuel cells, geothermal heat pumps, and small wind turbines, but only those made in the United States qualify.

Starting in 2024, homeowners can get an extra $1,200 in tax credits. This is for getting home energy audits and making energy-efficient upgrades. These updates include new windows, doors, insulation, and roofing. Homeowners can claim this credit on Form 5695.

What is the Solar Energy Tax Credit?

The Solar Tax Credit is a federal tax credit for installing solar energy systems. It can reduce your federal tax liability when you file your income taxes. For 2024, the tax credit is 30% of the total cost of your solar energy system.

This credit helps make solar energy more affordable by providing a dollar-for-dollar reduction on your taxes. You must activate your solar energy system this year to receive the credit. You also need to complete IRS Form 5695.

Tax Credits vs. Deductions and Discounts : Amount You Can Claim

Tax credits, unlike deductions, directly reduce the amount of tax you owe, potentially resulting in a tax refund. These credits are not discounts. You have to pay for the improvements first and then get the credit when you file your tax return. You can claim tax credits on IRS Form 5695 regardless of whether you itemize deductions on Schedule A.

Eligibility for the Residential Clean Energy Credit 2024

To get the Residential Clean Energy Credit for solar projects on homes in the U.S., you must meet specific requirements.

- Resident: You must live in the United States and have an outstanding federal income tax liability. Real estate located outside the U.S. does not qualify.

- New Energy System: Buy a new energy system like solar panels, wind turbines, or battery storage. Don’t buy used. It must meet certain requirements to qualify. Leased energy systems do not qualify.

- Property Ownership: You need permits and own the property to install an energy system where you live. You cannot claim the credit on full-time rental properties.

For comprehensive details, consult “A Complete Guide to The Solar Tax Credit.”

State-Specific Solar Incentives and Tax Credits

Some states provide tax credits for solar energy systems. These credits are in addition to the federal solar tax credit. You can claim the federal tax credit using Form 5695. As of 2024, a few states with notable incentives include:

- Massachusetts: Offers a state tax credit equal to 15% of the system cost, up to $1,000.

- Arizona:Offers tax incentives for solar energy systems, allowing deductions of up to $1,000 on state income taxes.

- In South Carolina, taxpayers can get a credit of up to 25% of the cost of solar panels for adoption. You can claim this credit over a period of 10 years.

Solar incentive programs at the state level are prone to alterations and can differ. Form 5695 doesn’t apply to state-level renewable energy incentives. A specialist from Palmetto can assist you in identifying and claiming applicable credits and rebates.

How to Fill Out IRS Form 5695 for the Solar Tax Credit

You can save money on solar energy systems and energy-efficient improvements by claiming the Residential Clean Energy Credit. Follow these steps to correctly fill out IRS Form 5695 and claim your solar tax credit.

Step 1 – Calculate the Total Amount of Your Solar Power System

To find the total cost, add all the money spent on your solar system. This includes the cost of equipment, labor, wiring, permits, and inverters.

Subtract Rebates: Deduct any cash rebates, state tax credits, incentives, and other rebates you received from the gross cost.

Enter on Line 1: Write the net amount on line 1 of Form 5695.

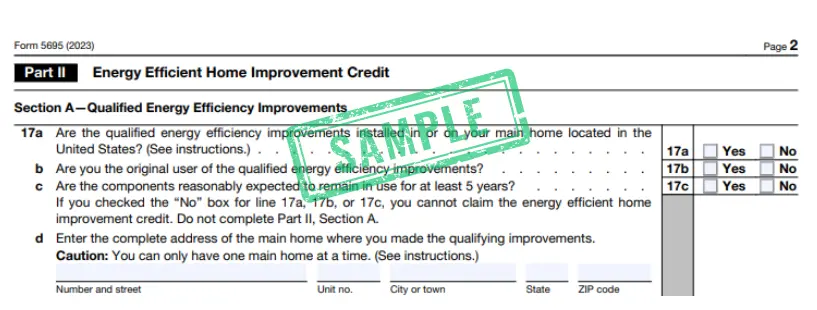

Step 2 – Add Additional Energy-Efficient Improvements

Incorporate Additional Enhancements: Input the aggregate expense of other eligible energy advancements on lines 2 to 5, like solar water heater, compact wind energy producers, geothermal heat pumps, and battery storage systems with a minimum capacity of 3 kilowatt-hours.

Sum Costs on Line 6a: Add the amounts from lines 2 through 5 and enter the total on line 6a.

Step 3 – Calculate the Tax Credit Value

Calculate 30% Credit: Multiply the total on line 6a by 30% to determine your federal solar tax credit.

Enter on Line 6b: Write this amount on line 6b. Skip lines 7 through 11 if you are not claiming credits for fuel cells.

Step 4 – Enter Your Tax Credit Value

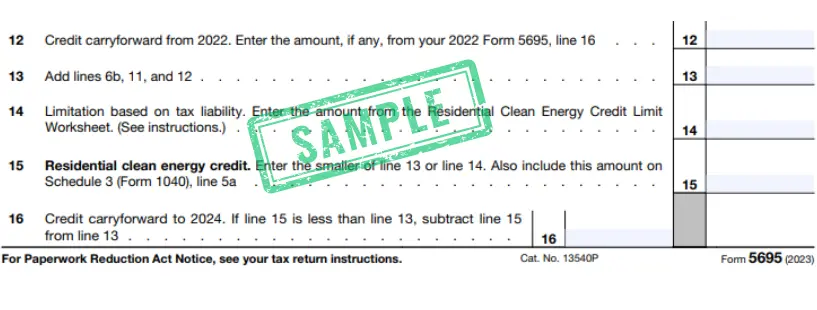

New to applying for the solar tax credit? Just transfer the number from line 6b to line 13 on Form 5695.

If you have tax credits from previous years or extra credits for fuel cells, make sure to adjust line 13.

Step 5 – Calculate Your Tax Liability

Check Tax Liability: Ensure your income qualifies to receive the full 30% tax credit in one year. Consider consulting a tax professional for accurate calculations.

Step 6 – Calculate the Maximum Tax Credit You Can Claim

Complete the worksheet by following the instructions on page 4 of Form 5695. Determine the maximum tax credit you are eligible for. Additionally, see if you qualify for credits for electric vehicles or mortgage interest. Remember to also check if you qualify for credits for electric vehicles or mortgage interest.

Enter on Line 14: Input the result from the worksheet on line 14.

Step 7 – Enter Your Maximum Tax Credit

Write the amount from the Residential Clean Energy Credit worksheet (the maximum tax credits you can claim) on line 14. Then, compare the amounts on lines 13 and 14 and enter the smaller one on line 15 of the form.

Step 8 – Calculate Any Carry-Over Credit

Find Carry-Over by subtracting line 15 from line 13. This will show how much you can carry over to next year’s taxes. If you owe less in taxes than your available credit, you can carry over the difference.

Enter on Line 16: Write this carry-over amount on line 16.

Step 9 – Enter Your Credit on Form 1040

Move to Schedule 3: The sum on Form 5695’s line 15 is the credit you’re eligible to claim for this year. Enter this amount on line 5 of Schedule 3 in Form 1040.

To get the most out of your Residential Clean Energy Credit for solar panels, fill out Form 5695 correctly. First, carefully review the form and gather all necessary information. Next, accurately input the required details in the designated sections. Finally, double-check your entries to ensure accuracy before submitting the form.

Timeline, Tips, and Troubleshooting for IRS Form 5695

Timeline for Filing Form 5695

You must complete Form 5695 for the tax year in which you installed your solar panel system. For example:

Purchase Date: February 2024

Solar Installation Date: First week of May 2024

Filing Time: File Form 5695 when you file your 2024 taxes, typically in late winter or early spring of 2025.

Tips for Success

Keep All Paperwork:

Documentation: Maintain all records from the initial sales conversation through the entire lifespan of your solar panels.

Accessibility: Keep your system’s information in a secure and easily accessible location to prevent last-minute searches when filing.

Timely Filing:

Eligibility: Ensure you file your taxes on time to retain eligibility for the Residential Clean Energy Credit.

Credit Rollover: If you file on time, you can carry over the credit to the next year. However, you cannot claim it in a tax year after you install the system.

Professional Assistance:

Expert Help: Engage tax professionals to assist with the filing process.

Maximize Value: Experts can help you complete Form 5695 accurately and get the most tax credit for your investment.

By adhering to these guidelines, you can streamline the process of claiming your solar tax credit and avoid common pitfalls.

Instructions For Form 5695

The solar tax credit offers a significant financial incentive for homeowners to invest in solar panels. Here’s how you can claim the Residential Clean Energy Credit:

Verify Your Eligibility

Ensure that your solar energy system and your situation meet the requirements for residential energy efficient property energy credits.

Fill Out Form 5695

Accurately complete Form 5695, providing all necessary information about your solar energy system and other qualifying energy-efficient improvements.

Include Form 5695 with Your Tax Return

Attach the completed Form 5695 when you file your annual tax return to claim the credit.

Contact Solar Earth Inc For more info

Solar Earth Inc, a leading clean energy company, advocates for the transformative power of solar energy. While we provide comprehensive solar solutions and solar financing options. We can help you with Form 5695 and applying for the Residential Clean Energy Credit.

Solar Earth Inc dedicates itself to promoting clean, renewable energy through solar power systems and battery storage solutions. Contact us to learn how we can enhance your solar experience. We can help you maximize the benefits of solar energy.